Payroll calculator for hourly employees

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. How to calculate payroll for tipped employees.

Forecast Payroll Calculations

If you have hourly employees you know just how difficult it can be to manage their hours and run payroll.

. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Hourly Paycheck and Payroll Calculator. Determine the right amount to deduct from each employees.

2 unemployment compensation insurance the unemployment tax rate is usually somewhere between 2 and 5 of. Injury and Illness Allows users to calculate injury and illness incidence rates for their specific establishment or firm and to compare them with the averages for the Nation for States and for the industry in which the establishment. Understand your nanny tax and payroll obligations with our nanny tax calculator.

The first worksheet is the employee register intended for storing detailed information about each of your employees. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. Need help calculating paychecks.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If you would like to see a detailed rundown head on over to our step-by-step guide for more information. See Minnesota tax rates.

Deduct federal income taxes which is the biggest tax that your employees will pay. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Easily find out how the buying power of the dollar has changed over the years using the inflation calculator. California Hourly Paycheck and Payroll Calculator. This Nebraska hourly paycheck calculator is perfect for those who are paid on an hourly basis.

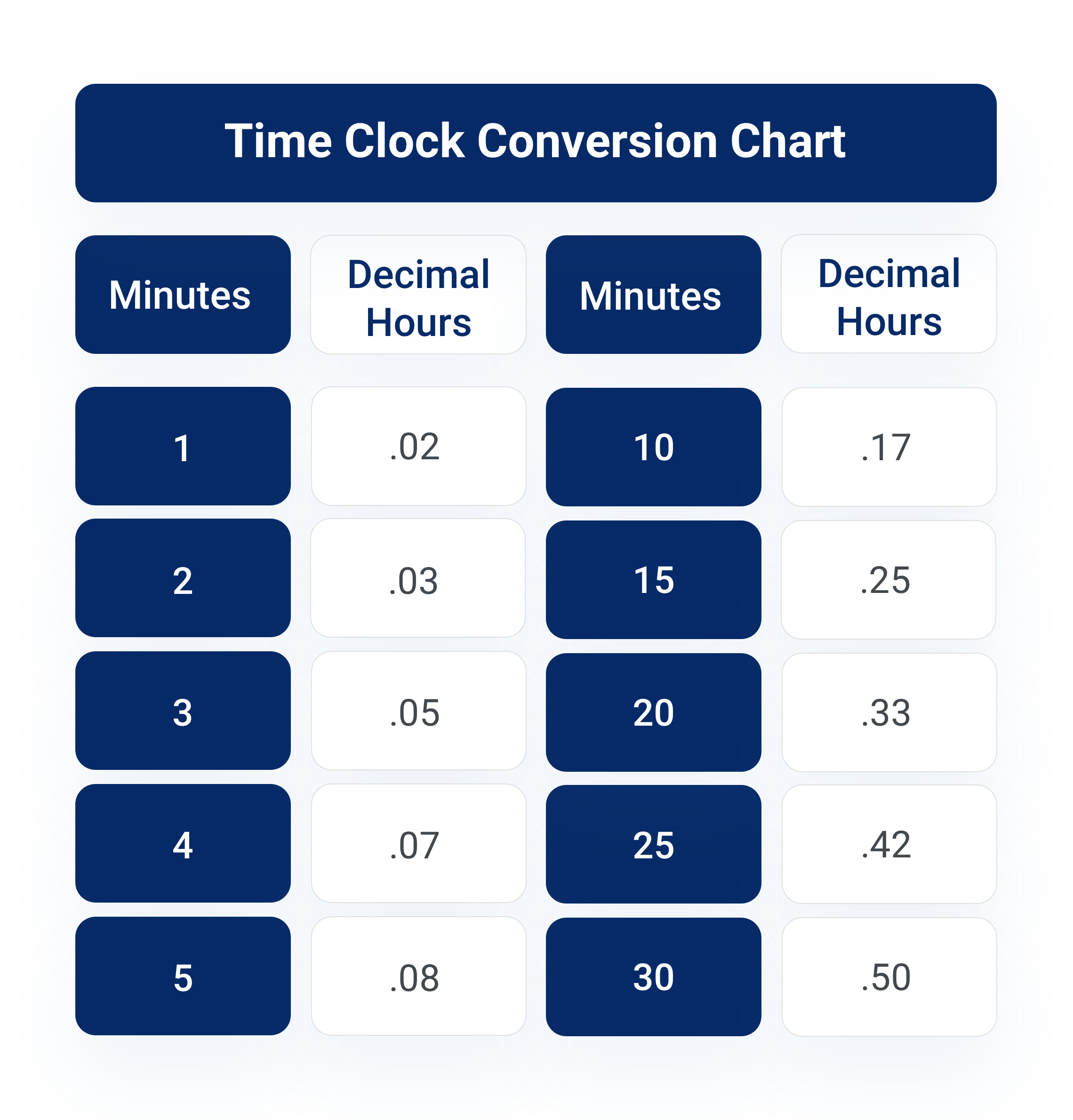

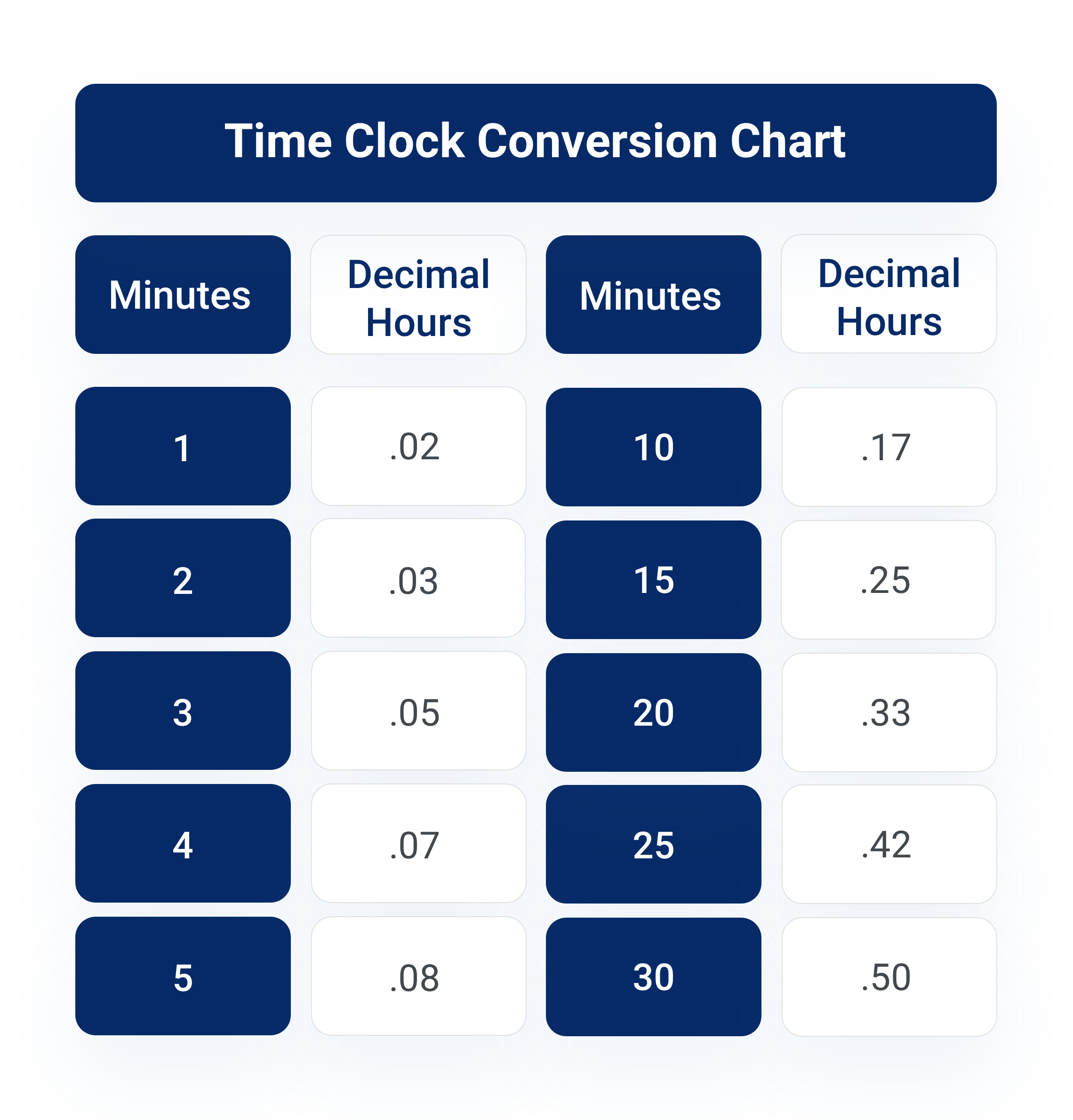

Federal Payroll Taxes. The data is then automatically fed to payroll so you dont need to worry about time clock conversion or timesheet calculators. Well do the math so you can write paychecks and take care of taxes.

Dont forget to. To keep things simple for you as the business owner we recommend using a tax tip calculator like this one to make sure youve got your withholdings. Switch to Washington salary calculator.

There has long been a disconnect between the average wage earner and the top percentage of wage earners. Exempt means the employee does not receive overtime pay. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use Our Free Hourly Paycheck Calculator. This Oregon hourly paycheck calculator is perfect for those who are paid on an hourly basis. Need help calculating paychecks.

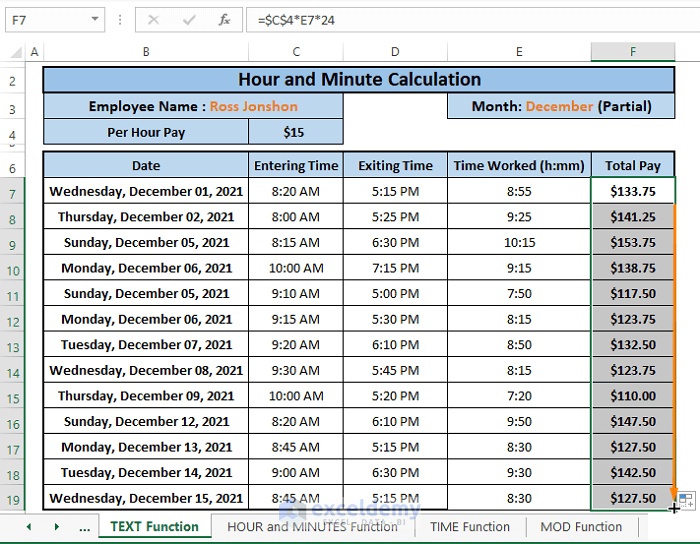

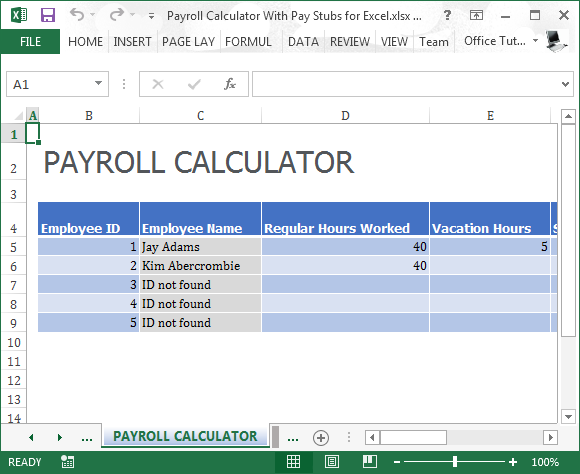

For all your hourly employees multiply their hours worked by the pay rate. This payroll template contains several worksheets each of which are intended for performing the specific function. This Washington hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Luckily our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for. This Idaho hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Then enter the employees gross salary amount. For all your hourly employees multiply their hours worked by the pay rate. Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees.

Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours sick leave hours and vacation.

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior. Employers are required provided certain conditions are. Your employees can use our time tracking software to seamlessly log their hours.

Employers must provide an employee with 24 hours written notice before a wage change. Switch to Missouri salary calculator. Switch to Oregon salary calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. 1 federal payroll taxes employers must pay a 765 Social Security tax and a smallusually 08 federal unemployment tax out of their own pockets. For all your hourly employees multiply their hours worked by the pay rate.

Heres a quick overview of what you need to know when youre calculating federal payroll taxes. Were making it easier for you to process your payroll and give your employees a great experience with their payslips. With Hourly you can handle all of your employee time tracking and payroll needs with one digital solution.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Nebraska salary calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Many employers do not understand the extent of employee expenses which include. The best illustration of this fact is that the wage rate of Americas CEOs 1 has been growing much faster than the middle and lower brackets of wage earners.

The tax rate can range from 0 all the way up to 37. Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance. SurePayroll does all the calculations for you allowing you to focus on more important areas of your small business.

Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees. Dont forget to increase. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Time. On tips as easy as possible is a win-win for everyone so you can withhold the right amount of taxes from their hourly or salaried base wages. All you have to do.

Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program. The pandemic has served to exacerbate the gap between CEOs and the average worker. If your employees have 401k accounts flexible spending accounts FSA health savings accounts HSA or any other pre-tax withholdings subtract them from gross wages prior to applying payroll taxes.

Fortunately you dont have to tackle this task on your own. Simply grab each employees W-4 and wage information and enter them into our handy payroll withholding calculator. Heres a summary of what you need to know when youre calculating federal payroll taxes.

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

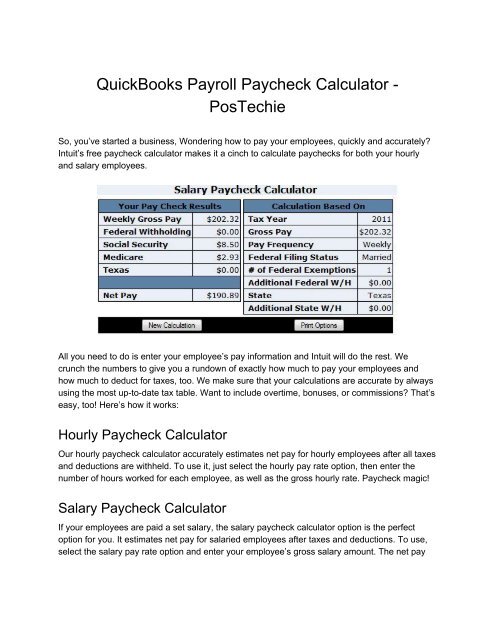

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Payroll Calculator Application Devpost

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Payroll Calculator Free Employee Payroll Template For Excel

Time Clock Conversion Calculator For Payroll Hourly Inc

Hourly To Salary What Is My Annual Income

Payroll Calculator Free Employee Payroll Template For Excel

3 Ways To Calculate Your Hourly Rate Wikihow

Paycheck Calculator Take Home Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Application Devpost

How To Calculate Payroll For Hourly Employees Sling

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates